Latest news

View all news

April 18, 2024

Bombardier to Report First Quarter Financial Results and Hold Annual General Meeting of Shareholders on April 25, 2024

April 3, 2024

Bombardier Becomes Only Business Jet Manufacturer to Disclose Environmental Impact of its Entire Aircraft Portfolio

March 27, 2024

Bombardier’s Industry-Leading Global 7500 Aircraft Actively Touring Asia, Showcasing its Unrivalled Performance and Design Attributes

Our business jets

For 50 years, we have shaped private flight. Today, our portfolio of business jets are the product of a strong heritage and visionary innovation.

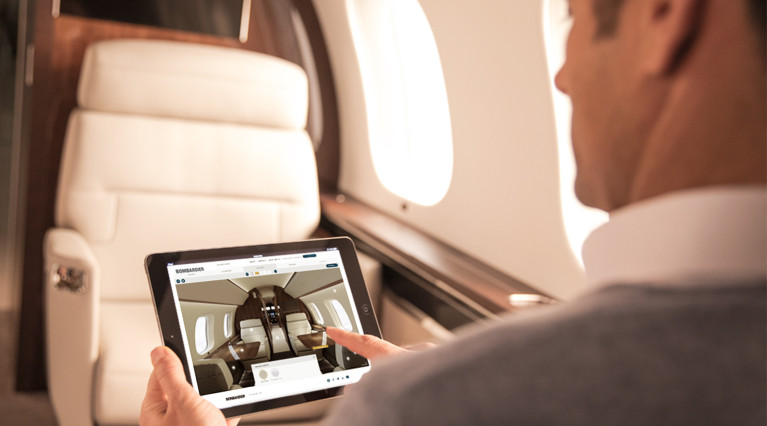

Virtual Showroom

Discover our aircraft

from the comfort of your own home

The Ownership Experience

From outstanding maintenance to industry leading aircraft enhancements, we offer a comprehensive support network to keep you flying.

A rich heritage of visionary leadership

Over 50 years of innovation. Of fine craftsmanship. Of seeing opportunities where others see limits.

Our rich history inspires us to relentlessly reinvent and refine every detail of every business aircraft. It’s just who we are.